TCL #45: Copper's Surge and Green Pivots

This week's updates in mining and energy highlight efficiency drives and strategic pivots. Codelco's investment in I-Pulse tech to cut energy use in copper production, BHP's potential Arizona mine restarts amid rising prices, GM's EV strategy reassessment with a $1.6B charge, ENEOS-NGEL green methanol collaboration, Toyota-Chiyoda hydrogen electrolysis push, and challenges for INEOS, plus biotech and J&J earnings gains.

Mining

- Codelco, a Chilean state-owned mining company and the world's largest copper producer, has invested in I-Pulse Inc., a US-based company that develops high-pulsed power (HPP) technologies. This move makes Codelco a strategic investor in I-Pulse, joining other major mining companies such as Rio Tinto, Newmont, and Teck Resources. Codelco plans to use I-Pulse's technologies to improve the energy efficiency of processes such as rock fragmentation, precision cutting, and drilling. I-Pulse states:

Our technology can reduce the energy required to unlock critical minerals from rock by up to 80%.

This could have significant ramifications for the industry, which currently relies on ball and SAG (Semi-Autogenous Grinding) milling techniques, which are energy-intensive.

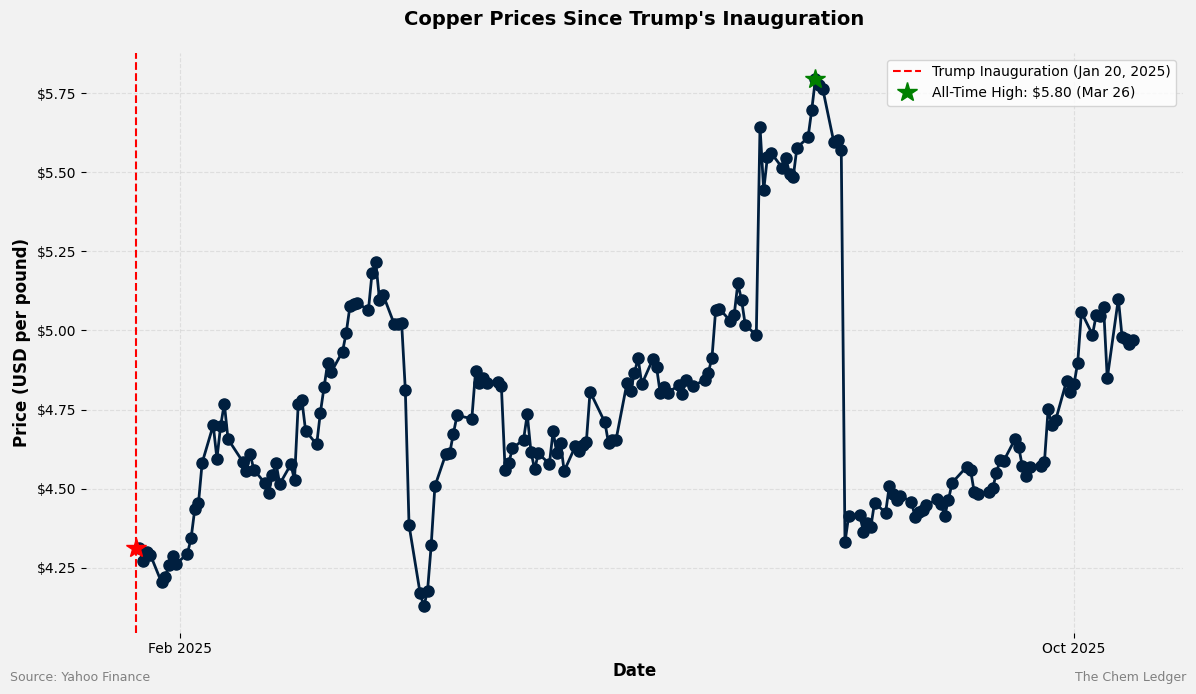

- BHP, an Australian multinational mining and metals corporation, is considering opening four long-dormant copper mines in Arizona, a key region for copper production in the U.S. The potential move is influenced by rising copper prices (see chart above) and shifts in US critical minerals policy, particularly under the Trump Administration.

EV

General Motors (GM) is taking a $1.6 billion charge, a strategic maneuver driven by shifts in its electric vehicle (EV) strategy and the impact of altered US federal EV tax credits. This charge includes $1.2 billion for adjustments in EV capacity and $400 million for contract cancellations and commercial settlements. The company's earlier goal was to have an all-electric lineup by 2035, but recent market reception and regulatory changes have led to a reassessment of that goal.

Green Methanol

ENEOS, a Japanese petroleum company, and NTPC Green Energy Limited (NGEL), an Indian state-owned enterprise, are collaborating on the production and supply of green methanol and green hydrogen derivatives in India. NGEL will produce these products in Andhra Pradesh, with ENEOS set to receive the green methanol for use as marine fuel. NGEL has already established a presence in the green energy sector with over 7.2 GW of generation capacity and is pursuing a goal to expand this to 60 GW by 2032.

Hydrogen Production

Chiyoda Corporation, a Japanese integrated engineering company, and Toyota Motor Corporation are jointly developing a large-scale water electrolysis system designed to produce hydrogen from water. This collaboration leverages Toyota's expertise in fuel cell technologies, including their cell stack and mass production knowledge, combined with Chiyoda's capabilities in process plant design and large-scale plant construction. Chiyoda will manufacture and sell the water electrolysis equipment utilizing Toyota-manufactured stacks.

Aviation Fuel

Topsoe, Sasol, and Griesemann are collaborating with the German Aerospace Center (DLR), Germany's national research center for aeronautics and space, on e-fuels demonstration research plant in Germany. Griesemann is acting as the engineering, procurement, and construction (EPC) contractor for this facility, which is expected to produce 2500 tons of e-fuels per year starting in Q4 2027. The project is backed by €130 million (~ $151 million) from the German Federal Ministry for Transport.

Specialty Chemicals

INEOS has confirmed its intention to shut down two production units at its Rheinberg, Germany site. The closures are attributed to several factors, including crippling energy and carbon costs, lack of EU tariff protection and crisis within Europe's chemical industry. The specific units affected include the allylics plant and chlorine production plants.

Biotech

Kailera Therapeutics, a US-based biotech company, has raised $600 million in Series B to accelerate its obesity treatment pipeline. The financers included major investors like Bain Capital, the Canada Pension Plan Investment Board, and the Qatar Investment Authority, among others. Kailera has a significant presence and partnership in China and has licensed obesity therapies from China, with its most advanced program, KAI-9531 (developed in China as HRS9531), being an injectable GLP-1/GIP receptor dual agonist.

Earnings

Johnson & Johnson reported third-quarter 2025 results with reported sales growth of 6.8% to $24 billion. The company now expects sales of $93.5 billion to $93.9 billion for the year, up from the previous range of $93.2 billion to $93.6 billion.