The Chem Ledger #10: Exelixis, Sanofi, Alto, Waldner, Oxyle, Cyclyx, and Enveda Lead Industry Updates

Regulatory Updates, M&A, Investments, and Collaborations in the Pharma, Chemicals, and Startups.

Oncology

Exelixis has provided a regulatory update regarding its Supplemental New Drug Application (sNDA) for cabozantinib, aimed at treating patients with previously treated advanced neuroendocrine tumors (NET). The FDA's Oncologic Drugs Advisory Committee (ODAC) will review data related to the safety and effectiveness of cabozantinib for this indication.

Pharma

1/ Sanofi has inaugurated a $590 million modular manufacturing plant in Singapore, specifically designed for the production of vaccines and biologics. This facility, known as Modulus, is notable for its ability to scale up production rapidly, potentially allowing for the creation of new vaccines or biologics within days.

2/ On November 27, 2024, Applied Therapeutics, a biopharmaceutical company based in New York City, received a Complete Response Letter from the FDA, indicating that the agency declined to approve the New Drug Application for govorestat. The FDA's decision was based on the need for additional data and analysis regarding the drug's efficacy and safety. Following the feedback, Applied Therapeutics plans to request a meeting with the FDA to discuss potential pathways for resubmission or appeal. Govorestat is classified as a central nervous system (CNS)-penetrant Aldose Reductase Inhibitor (ARI), primarily developed for the treatment of classic galactosemia, a condition that affects the body's ability to process the sugar galactose.

3/ Acadia Pharmaceuticals has entered into an exclusive worldwide license agreement with Saniona for the development and commercialization of SAN711, a treatment aimed at neurological disorders. The total deal value is up to $610 million, which includes potential milestone payments and royalties. SAN711, developed by Saniona, primarily targets essential tremor, a neurological disorder characterized by involuntary shaking.

Coatings

The Waldner Group has initiated the construction of a new powder coating plant, which is expected to commence operations in autumn 2025. This facility will enhance the company's surface coating capacities and is part of a broader strategy to optimize production processes at their headquarters in Wangen, Germany.

Specialty Chemicals

Alto Ingredients will cold idle the Magic Valley, Idaho facility by December 31, 2024. This decision is driven by forecasts indicating "very low to negative crush margins in the West" making it "fiscally prudent" to halt operations temporarily. The company is a producer of specialty alcohols and high-value ingredients, primarily serving industries such as health, food and beverage, home and beauty, and renewable fuels.

Startups

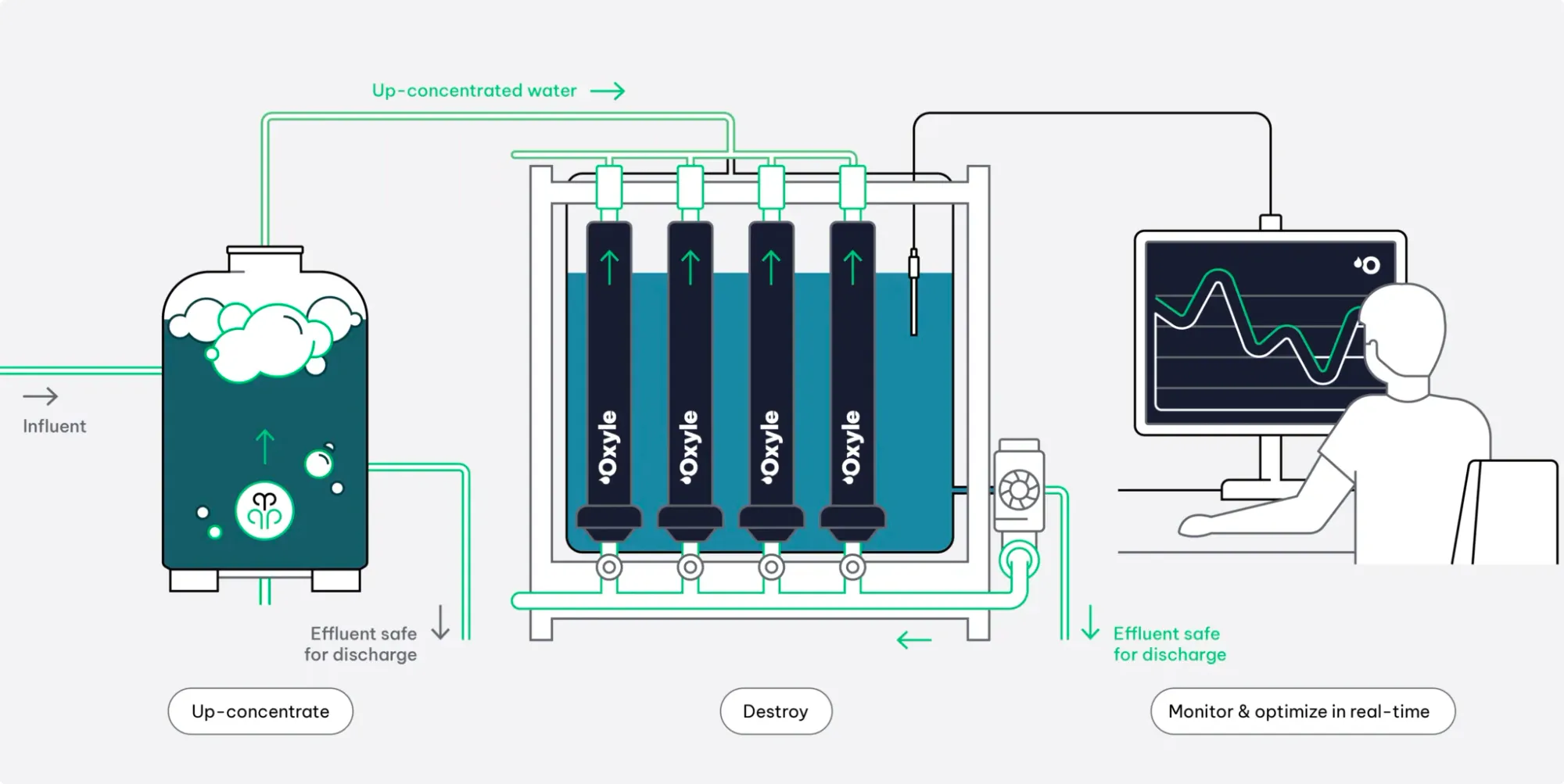

1/ Oxyle, a Swiss start-up, has recently commissioned its first complete PFAS (per- and polyfluoroalkyl substances) destruction system in Switzerland. The system is designed to effectively and affordably treat PFAS-contaminated water, addressing a significant environmental challenge posed by these "forever chemicals". The system reportedly consumes 15 times less energy on average compared to other destructive treatment methods. The system can treat up to 10 cubic meters of contaminated water per hour, which is crucial for large-scale remediation efforts.

2/ Ghove Energy, a startup focused on commercializing advanced lithium-sulfur (Li-S) battery technology developed at Monash University, is raising pre-seed funding. Li-S batteries can theoretically achieve an energy density of around 500 Wh/kg, significantly higher than the typical 150-250 Wh/kg of lithium-ion batteries. This is primarily due to the high specific capacity of sulfur, which can reach approximately 1675 mAh/g. The advancements in Li-S battery technology could revolutionize electric vehicles and aerospace by enabling longer ranges, faster charging, and lightweight, efficient energy solutions for aircraft and drones.

3/ Molyon, a startup spun out from the University of Cambridge, raised around $4.6 million in its first funding round, co-led by IQ Capital and Plural. This funding will be used to expand its team and support the manufacturing processes at its pilot facility in Cambridge. Like Ghove, Molyon aims to create next-generation Li-S battery technology, utilizing earth-abundant materials to enhance sustainability.

4/ Ecolectro, a startup based in Ithaca, New York, and focused on green hydrogen technology, has raised $10.5 million in a Series A funding round. This round was led by Toyota Ventures and aims to accelerate the development and deployment of Ecolectro's Anion Exchange Membrane (AEM) electrolyzers designed for efficient hydrogen production. The funding will support advancements in their technology, contributing to the broader goals of sustainable energy and low-cost green hydrogen production.

Collaborations

1/ Cyclyx has announced plans to invest in its second Cyclyx Circularity Center (CCC2), which will be located near Fort Worth, Texas. This facility aims to enhance the aggregation and recycling of various types of plastic waste, including post-consumer, commercial, and industrial plastics that are often sent to landfills. The CCC2, is part of a joint venture involving Agilyx, ExxonMobil, and LyondellBasell. The center will have the capacity to produce approximately 300 million pounds of plastic feedstock per year, supporting both advanced and mechanical recycling processes.

2/ INEOS and Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) have signed a Memorandum of Understanding (MoU) to establish a new world-scale acetic acid production facility in India. This collaboration marks a significant step in enhancing domestic production capabilities in the country, which currently imports 85% of its requirements. The proposed plant is expected to have a production capacity of approximately 600,000 tons per year.

3/ ArcelorMittal Poland and Linde Gaz Polska are collaborating on a project to construct a hydrogen production plant at ArcelorMittal facility in Krakow. This initiative is part of ArcelorMittal's broader strategy to integrate hydrogen solutions into its operations, particularly to enhance the sustainability of steel production.

4/ KBR has entered into an agreement with AMUFERT for the development of a new ammonia plant in Soyo, Angola. This partnership will utilize KBR's proprietary ammonia technology, which is recognized for its efficiency and sustainability. The plant is expected to play a significant role in enhancing local agricultural productivity and supporting sustainable practices in the region.

M&A

1/ Carrier Process Equipment Group, Inc. (CPEG) has acquired Hebeler, LLC. This acquisition enhances CPEG's position as a leading provider of thermal processing solutions. The integration of Hebeler brings well-known brands such as Buflovak and Patterson Kelley into CPEG's portfolio, expanding their capabilities in evaporation, distillation, and solidification processes.

2/ Advanced Automation Technologies (AAT), based in Maryland, USA, agreed to acquire GERSTEL that specializes in automated sample preparation solutions for laboratories, particularly in the fields of Gas Chromatography/Mass Spectrometry (GC/MS) and Liquid Chromatography/Mass Spectrometry (LC/MS).

3/ Berlin Packaging, a global supplier of hybrid packaging solutions, has announced plans to expand its operations in Germany by acquiring Rixius AG, a supplier known for its rigid packaging solutions across various sectors. The main shareholder of Rixius AG, BWK, a German Investment firm, will exit its investment upon the completion of this acquisition.

4/ RAITH, a German company specializing in maskless nanofabrication and characterization systems, has recently acquired Xnovo Technology ApS, a Danish company known for its advanced imaging and materials characterization technologies. This move aims to enhance RAITH's capabilities in nanofabrication and imaging solutions, integrating Xnovo's expertise into RAITH's existing portfolio. Xnovo will continue to operate independently while leveraging RAITH's resources to enhance its services and innovation.

Investments

Elchemy has developed a proprietary system called DOMS that serves as a strategic tool for improving operational excellence in supply chain management. (Video: Elchemy)

1/ Elchemy has secured $5.6 million in Series A funding, led by Prime Venture Partners and InfoEdge Ventures. This funding will be utilized to enhance their technology, expand their team in the United States, and invest in supply chain solutions. Elchemy operates as a cross-border specialty chemical distribution platform, connecting international buyers with suppliers in India and Southeast Asia, thereby simplifying the sourcing process.

2/ Cradle Bio recently raised $73 million in Series B funding round, which will be used to enhance its Artificial Intelligence (AI)-driven protein engineering platform. This funding round was led by IVP and brings Cradle's total funding to over $100 million. The company aims to leverage generative AI models to accelerate protein discovery, impacting various sectors in cluding therapeutics and agriculture.

3/ 360 ONE Asset, an asset and wealth management firm based in Mumbai, India, has acquired a stake in OneSource Specialty Pharma, a Contract Development and Manufacturing Organization (CDMO) that specializes in biologics and complex injectables. OneSource Specialty Pharma is positioned to become a significant player in the industry, and this investment is expected to support its growth and innovation efforts.

4/ Enveda Therapeutics, based in Colorado, USA, has raised $130 million in Series C funding round. This funding will support the company's efforts to advance its drug discovery initiatives, leveraging AI to translate natural compounds into new medicines. The round was oversubscribed and led by Kinnevik and FPV, with participation from various investors including Baillie Gifford and Lux Capital. The funds are expected to facilitate multiple clinical readouts from a pipeline of 10 development candidates by 2025 and 2026.

5/ ADNOC (Abu Dhabi National Oil Company) has launched XRG, an initiative aimed at investing over $80 billion in low-carbon energy and chemicals. XRG is designed to operate independently from ADNOC, with the goal of doubling its asset value by 2035.

If you’d like to receive these weekly updates directly in your inbox, please enter your email below. Stay informed and ahead with the latest developments in the chemical and materials industries, delivered right to your inbox.

Discover more about me here.